General News

20 April, 2023

Scam warning for locals with record losses reported across Australia in 2022

Australians lost a record $3.1 billion to scams in 2022, but the true figure is likely to be a lot higher according to the Australian Competition and Consumer Commission (ACCC). The figure is a staggering 80 percent increase on total losses in 2021...

Australians lost a record $3.1 billion to scams in 2022, but the true figure is likely to be a lot higher according to the Australian Competition and Consumer Commission (ACCC).

The figure is a staggering 80 percent increase on total losses in 2021, despite the fact Scamwatch received 16.5 percent fewer reports of scams in 2022.

The findings come from the latest Targeting Scams report which compiles data reported to the ACCC’s Scamwatch, ReportCyber, Australian Financial Crimes Exchange and other government agencies.

The report showed investment scams were the highest loss category ($1.5 billion), followed by remote access scams ($229 million) and payment redirection scams ($224 million).

Losses experienced by each victim rose by more than 50 percent to an average of almost $20,000 due in part, according to the report, to scammers using new technology to lure and deceive victims.

Small and micro businesses also suffered signficant losses to scams in 2022 ($13.7 million), up 95 percent from 2021. The biggest contributor to these losses were payment redirection scams — also known as business email compromise.

“Australians lost more money to scams than ever before in 2022, but the true cost of scams is much more than a dollar figure as they also cause emotional distress to victims, their families and businesses,” ACCC deputy chair Catriona Lowe said.

“Scammers evolve quickly and unfortunately, many Australians are losing their life savings. We have seen alarming new tactics emerge which make scams incredibly difficult to detect.

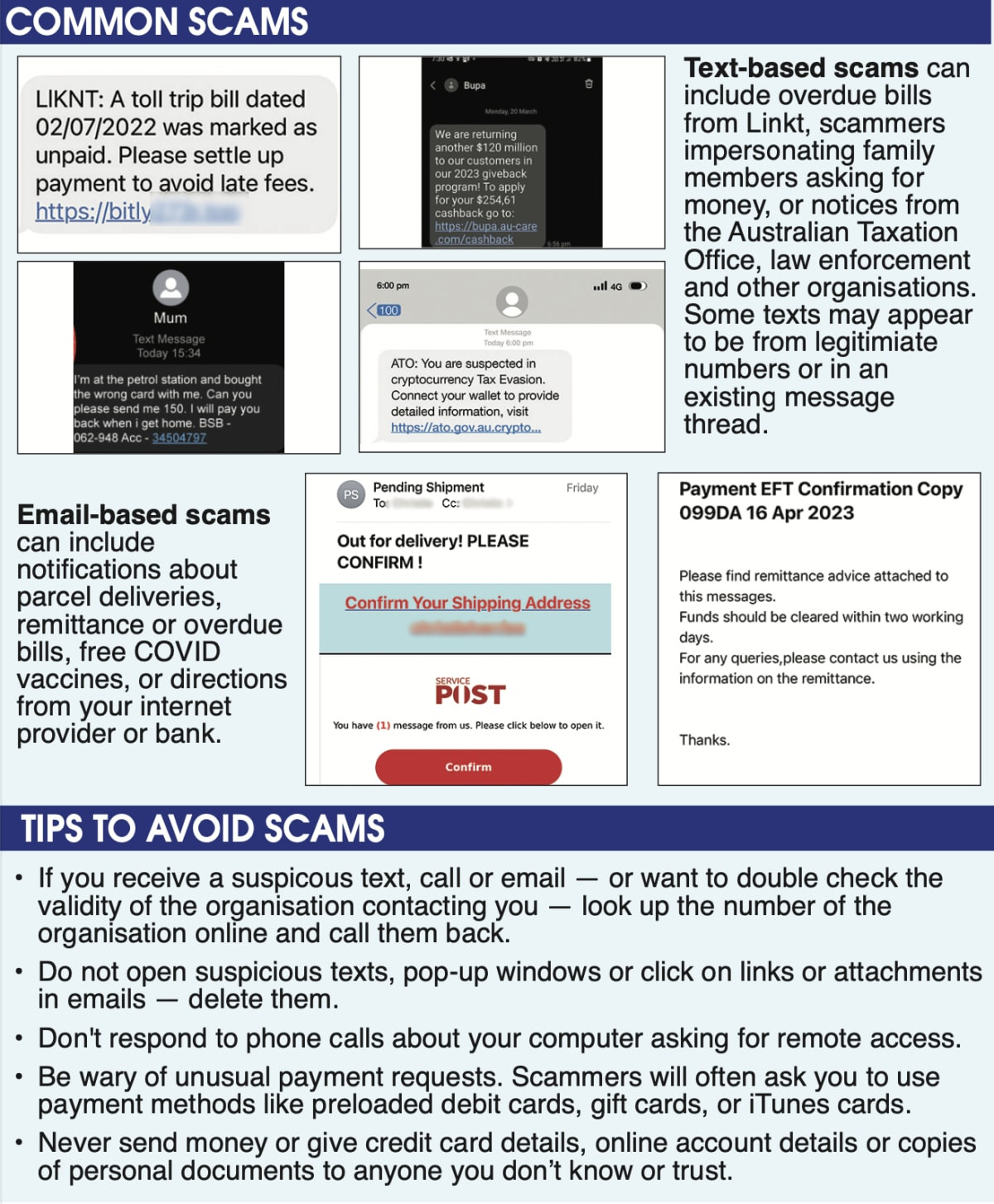

“This includes everything from impersonating official phone numbers, email addresses and websites of legitimate organisations to scam texts that appear in the same conversation thread as genuine messages. This means now more than ever, anyone can fall victim to a scam.

“There has been an explosion of reported losses to phishing scams in the past year, such as ‘Hi Mum’ and Toll/Linkt text scams, which skyrocketed by 469 percent to $24.6 million in 2022.”

People experiencing vulnerability also suffered record financial losses — people with a disability reported losses of $33.7 million, a 71 percent increase from 2021.

Indigenous Australians reported losses of $5.1 million (up five percent) and people from culturally and linguistically diverse communities made 11,418 scam reports which resulted in losses of $56 million (up 36 percent).

“We are very concerned that people experiencing vulnerability continue to be disproportionally impacted by scams,” Ms Lowe said.

“Our report shows that people from culturally and linguistically diverse communities were significantly over-represented in terms of financial losses across a range of scam types, accounting for more than one quarter of total losses associated with identity theft and about a third of all losses to pyramid schemes.

“This is a worrying trend that urgently needs to be addressed by both government and industry with input from consumer advocacy groups.”

Quick thinking saves local’s phone

The Advertiser has had a number of reports of locals being targeted by scams in the past month, including just this week when a Maryborough resident — who asked not to be named — was a target of the Toll/LinkT text scam.

“I had just been to Melbourne the week before, and I’d also just paid a parking ticket online, when I got a text saying my Toll payment needed to be paid,” the resident said.

“I thought ‘I haven’t been on any toll roads’, but given I’d just been to the city and paid another ticket, I clicked the link as I thought it could be legitimate.

“It took me to a blank webpage and I knew something was wrong.”

The resident said he contacted his bank straight away, which recom-mended taking the phone to a mobile phone repair shop to be cleaned, and thankfully it appears no information or money was stolen.

Maryborough’s Microblast Computers cleaned the phone and owner Dale Martin said unfortunately, scamming software is not uncommon.

“We’d probably see three or four people for this kind of thing a week. Usually the banks send people in [who’ve clicked on a scam link] because they won’t re-enable online banking until the phone has been cleaned up,” he said.

“There’s plenty of this scamming software around. Once you click on a scam link and it downloads and installs software, scammers can monitor your phone screen and see what you’re clicking on — including entering your banking details which is primarily what they’re after.”

Mr Dale said shops like Microblast can clean out phones to remove malicious software from scams, but ultimately advised residents to be vigilant and never click on links, allow too many permissions required by apps, and if in doubt hang up the phone.

“My advice is say no, no matter what you’re being asked to do or click. Places like Telstra will never call you, even if you have a problem and have previously contacted them,” he said.